Speak to a Loan Guide

Keen to get started or

ask loan questions, our

Loan Guides can help.

Put that lazy equity to work with a painless cash out refi.

Access your cash in as little as 14 days.

Loan options for all kinds of situations.

Increase your ROI, renovate or roll in it!

Watch how to apply in under 10 minutes.

We partner with

Why investors use Beeline

for cash out refis.

Loans made just for investors.

A dedicated experience that doesn’t cram you down the normal path whether you’re a tycoon or a first timer.

More loan options means you’re more likely to qualify.

DSCR loans to qualify with the property’s rental income, not yours. We have STR, multi family, bridge and portfolio loans too.

Get certainty faster.

You’ll get a reliable approval and loan options in quick time, so you know how much you can cash out.

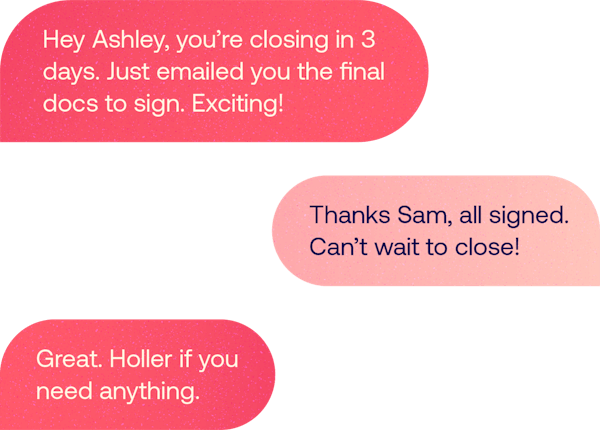

Fast, stress-free closing.

Your dedicated Loan Guide, your Beeline Tracker and our tech mean less back and forth and you’re always in the loop.

A bigger bag of loan options means we can help more people.

If your situation is easy, we can give you loan options in minutes.

But if your situation isn't so easy, or if you’re one of 73 million gig economy workers or a property investor, other lenders will put you in the ‘too hard’ basket.

Beeline’s wider variety of loan options means you’re less likely to waste time and more likely to find a solution.

If you’re self employed with irregular income we’ve got bank statement loans. If you’re investing, DSCR loans are ideal to qualify with rental income instead of yours.

Why can’t it be easy for everyone?

![[object Object]](/static/pricepact-cb4e081f06fe44a0d2ee7a5982be071f.png)

Investment property loans FAQs

Can I borrow through my LLC?

What's the minimum loan amount?

What's the minimum down payment for investment loans?

What's the deal with DSCR?

Can I do a cash out refi DSCR loan?

Do you do Fix n Flip loans?

Do you offer interest-only options for investment properties?

Never feel alone — your Loan Guide will

navigate you the whole way.

The Home Run.

Everything you need to know about real estate investing.

Tune in as we demystify topics like how to qualify for an investment loan, landlording tips and tricks, and how to build a real estate portfolio.

Walk away with clarity on how to achieve your real estate investment goals and that sweet, sweet financial freedom.

![[object Object]](https://images.prismic.io/beeline/32bbe02a-09de-452d-8495-8d9b5451a96c_phone-laptop.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

Turn your equity into cash you can actually use.

Whether you’re releasing untapped equity to buy another property, renovating or just treating yourself.

Get the loan out of the way and your cash out so you can get to your financial happy place sooner.

![[object Object]](/static/investment-homes-e324a6eb3c34e4856959153c35908422.png)